Retiring earlier than planned? Adapting your retirement strategy (and outlook) may be necessary.

Involuntary retirement can be emotionally and financially unsettling. Here are some questions to ask yourself if it happens.

You may have to rely on your spouse or partner's income - or your emergency fund - for many months if you look for another full-time job. Finding part-time work may be more realistic.

Consider your investment accounts, your savings, and any passive income streams. If your significant other still works, factor in their pay. Determine whether to apply for Social Security at 62 or later. Claiming benefits at 62 results in smaller monthly lifetime income payments; claiming later results in larger monthly payments.1

See if you are eligible for severance pay or an early retirement package and/or COBRA or retiree health benefits.

In this situation, your spending should reflect your needs, not your wants. You can probably lower some households costs.

You may soon derive income from investment and retirement accounts. You will need to make tax-efficient withdrawals from them, so both the timing and order of these withdrawals is critical.

An early retirement may turn out to be a net positive, leading to a new chapter of your life. Get started today by speaking to an advisor.

1 smartasset.com/retirement/how-to-improve-your-social-security-benefits [12/14/16]

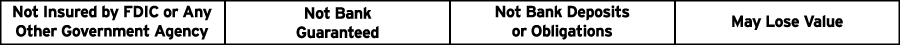

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products offered through LPL or its licensed affiliates. Seacoast Bank and Seacoast Investment Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Seacoast Investment Services, and may also be employees of Seacoast Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from,and not affiliates of Seacoast Bank or Seacoast Investment Services. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Topics: Invest & Retirement

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: