Reviewed by: Jo-El Gonzalez

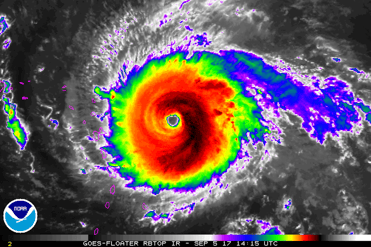

Living in Florida comes with plenty of perks, like mild winters, beautiful beaches and no state income tax. But it’s not always fun in the sun, especially when hurricane season rolls around each June through November. According to NASA models, hurricanes are increasing in severity, bringing more powerful rain, winds and flooding to Florida’s coastal areas. In 2022, Hurricane Ian careened into Southwest Florida, causing a record $109 billion in damage to the Sunshine State.

If you live in Florida, you know the risks of a hurricane are real. So, while you can’t control the weather, you can determine your preparedness when severe weather strikes. Taking the appropriate steps to ready yourself financially for a hurricane can help protect you and your loved ones.

Here are eight things every Floridian should consider when preparing financially for hurricane.

In the event of a hurricane, most paper documents don’t stand a chance. When a hurricane hits, the last thing you want to do is worry about replacing the lost deed to your home, passports, birth certificates and social security cards. To protect these items from loss or damage during a hurricane, keep all your important financial documents and identification cards in a waterproof, fireproof safe.

Even if you have a rock-solid safe, you might not be able to access it in a hurry or bring it with you on the go. While it’s nice to know your documents are safe, maintaining digital copies of identification cards, insurance information, deeds and other documents is imperative to prepare yourself during hurricane season. Once you have digital copies of all key records, make sure to upload them to cloud storage where you can access them from any device.

Most U.S. adults already use mobile and online banking tools, but if you aren’t one of them, it may be time to start. Hurricanes can cause prolonged blackouts and road closures, which can make visiting a bank branch dangerous or impossible. By utilizing online and mobile banking tools, you have quick visibility and access to critical banking functions, such as mobile deposits, bill pay and transactions. To get a head start on your hurricane preparedness, enroll in online banking, download your bank’s mobile app and consider receiving paperless statements.

Unfortunately, scams may rise after a storm. However, you can help protect yourself against fraud by recognizing common red flags and taking proactive measures.

Be on the lookout for emails, phone calls or text messages from anyone claiming to be a government official or from a charitable organization. Don't click the link if you receive a suspicious email, as it could be a phishing attempt. Additionally, if you receive a phone call or text from someone claiming to be with the government or charity, hang up and locate their phone number on their official website. If a government official comes to your door, ask for identification, and know they cannot ask for or accept money.

To further protect yourself, set online and mobile banking alerts so you're notified whenever a transaction occurs or after failed login attempts. If your bank or credit union offers debit card controls, consider limiting the types of businesses and locations your card will work and place spending limits on authorized transactions. If you suspect fraud, report it to your financial institution immediately.

Understanding your insurance coverage is crucial to helping you recover what you lost after a costly natural disaster like a hurricane. That’s why you should take the time to review your insurance policies annually. Details to consider are if your insurance policy is enough to protect you and how much is your deductible is. Additionally, make sure you understand the differences between what’s covered under flood insurance, homeowners or renters insurance, auto insurance and more.

Thanks to smartphones, taking a picture is easier than ever, and it doesn’t have to cost you anything. Besides keeping physical and digital copies of important documents, you should also take photos and videos of your home and personal property. This way, you can quickly and easily provide a detailed record of your home and belongings, which may help expedite the insurance claims process.

Though insurance can help make you whole again, it will likely only kick in after you pay the deductible, and sometimes, it takes days or weeks before your claim pays out. That means you need the funds to pay your deductibles, which can be several thousand dollars. You can use your emergency fund to pay for your insurance deductible or to cover living expenses while you wait for your insurance payout.

If you own your own home, another option to consider is a home equity line of credit (HELOC). A HELOC is a flexible option that allows you to borrow money against your home’s equity as needed. In contrast to a home equity loan and many other loan types, you can borrow money multiple times, and you’ll only have to pay interest on what you use rather than a single lump sum. You may also find the interest to be lower than using a credit card.

An emergency financial first aid kit is integral to successfully managing an unexpected disaster such as a hurricane. Besides physical copies of identification, financial and legal documents, you’ll also want to keep some cash handy in case you can’t get to an ATM or bank. For more tips on building your emergency financial first aid kit, visit the Federal Emergency Management Agency (FEMA) website.

A hurricane can form at any time and you need to prepare. Start by securing your documents in a weatherproof safe, adding digital copies of those documents to cloud-based storage, and enrolling in online banking with paperless statements. You’ll also want to review and understand your insurance coverages and begin establishing a hurricane emergency fund or opening a HELOC, which can provide for your immediate cash needs in case a storm strikes. Finally, you should prepare an emergency financial first aid kit, complete with some cash and hard copies of photo ID cards, insurance information and financial and legal documents.

If you’re a business owner, it’s important to have a disaster plan in place to minimize impact on your company. Review the nine things your company’s disaster plan should include.

Topics: Protect Your Finances, Financial Education

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: