Reviewed by: Jo-El Gonzalez

As the cost of living rises, it’s more important than ever to focus on your finances. Regardless of your income, budgeting is crucial to successfully managing your money. Individuals who budget effectively can better track their spending, plan for the unexpected and save for retirement, all while paying for necessary expenses and occasionally treating themselves.

At first glance, creating a budget can feel overwhelming. Fortunately, several budgeting strategies are simple and easy for anyone to follow, such as the 50/30/20 rule.

The 50/30/20 rule is a straightforward budgeting strategy that divides your spending into three buckets: mandatory expenses (needs), discretionary spending (wants) and savings (emergency savings, retirement savings, investing and paying off debt).

The 50/30/20 rule starts by addressing the non-negotiable expenses in your life. These mandatory expenses might fluctuate depending on where you live and your lifestyle choices, but for the most part, you can’t live without them.

Representing 50% of your spending in the 50/30/20 budget are your mandatory expenses — in other words, your essential needs. These expenses cover your necessities, like housing and food. Examples of necessities include:

Once you’ve taken care of your mandatory expenses, you can start thinking about how you want to spend your money and not just how you need to spend it. So with that, let’s discuss the next part of the 50/30/20 rule.

The second category accounts for 30% of your post-tax income and includes spending on creature comforts. Some examples of expenses that fall into this category are:

As the name suggests, discretionary spending is just that -- discretionary. As you're listing your discretionary spending, take the time to analyze whether you really want the items on your list. Instead of the short-term satisfaction that comes with dining out or specialty coffee, think about the joy that comes with building a solid nest egg for retirement or finally being debt-free.

It's ok to treat yourself with this portion of the budget, but putting these items into perspective may change your approach to saving.

Though roughly 71% of the U.S. population has a savings account, the median amount in those accounts is just $3,500 – likely insufficient funds to cover a month’s worth of expenses. Savings can take different forms, from short-term goals like reducing debt to long-term goals like contributing to retirement. Within your savings bucket, your categories may be:

When saving money, consider how much you need to cover unexpected budget shortfalls, such as a job loss or illness, as well as costs like college tuition, automobile repairs and home improvements.

It’s important to note that you have plenty of options when it comes to opening and maintaining a savings account. Before opening an account, analyze your unique needs and align them with an account that helps you meet them.

For example, traditional savings accounts typically have low opening and minimum balance requirements and pair easily with a checking account, potentially helping you avoid costly overdraft fees and making automated transfers into savings easy. You may also consider opening multiple accounts for various savings goals.

Personal money market accounts function similarly to traditional savings accounts, but usually offer a higher return on balances and offer check-writing and debit privileges.

If you have long-term savings goals and do not need immediate access to funds, a certificate of deposit (CD) account may be best, as they typically offer a locked interest rate on balances for a set term.

No matter your savings method of choice, it's important to prepare for the future and store money aside for unexpected expenses.

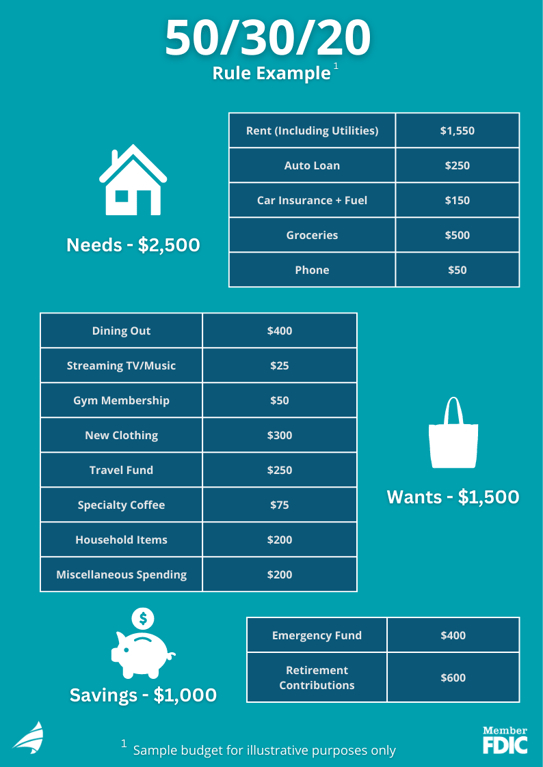

Let’s look at the 50/30/20 rule in action and see what that looks like in a real-life scenario. For simplicity, let's say you earn $5,000 per month after taxes. Using the 50/30/20 rule, you should spend at most 50% of your income, or $2,500, on necessities. Then, you can spend up to 30% of your income, totaling $1,500, on your wants. Finally, you should set aside at least $1,000 per month to account for the final 20% of your income, which you’ll use to save, invest or pay down debt.

While your personal budget will vary, you can get a sense of the breakdown of expenses in the graphic above.

The 50/30/20 rule offers a flexible solution to managing money that works with your specific budget. Splitting your spending into three separate categories makes it easy to stick to your budget while continuing to enjoy your life and improving your financial future. What are you waiting for? Start taking control of your financial future today!

Interested in additional tips for managing your finances? Explore Seacoast’s BankNote blog for guidance on home ownership, retirement, managing credit and more.

Topics: Manage Your Money

Are you interested in contacting a local, Florida banker to discuss your individual financial needs? We’d love to speak with you. Schedule a consultation today.

Share: